Capital Goods Price Index Explained: A Guide to Its Role in Economics

Ever wonder how companies calculate the cost of buying machinery and equipment critical for production? It all depends on the Capital Goods Price Index or CGPI. A less well-known but extremely important economic indicator, the CGPI gives an idea of changes in the prices of large industrial goods over time. It is a barometer that reflects not just price trends but also the health of the industries and their readiness to invest. An economist, business leader, or anyone who is curious about how the wheels of the economy turn would have a basic understanding of CGPI to decode broader market dynamics.

In this article, we’ll unpack the concept, how it works, and why it matters. By the time you’re done reading, you’ll see how this index influences everything from investment decisions to the global economic outlook.

What is the Capital Goods Price Index (CGPI)?

The Capital Goods Price Index is an economic statistic that reflects the price of capital goods, that is, the cost for businesses to produce other goods and services. Capital goods are usually those goods that involve heavy machinery, tools, buildings, and vehicles, which are some of the important requirements in manufacturing and industrial operations. These represent goods that are meant for investment and not for current consumption but rather contribute to the generation of future economic value.

For example, if a construction company needs cranes or bulldozers, the cost of those things is included in the calculation of the CGPI. The index is helpful in evaluating the cost pressures involved in acquiring the necessary inputs and determining the real state of industrial demand and supply.

The CGPI is particularly useful because of its status as a leading economic indicator. When capital goods prices rise or fall substantially, it tends to reflect changes in business investment patterns, which may be indicative of a turning point in economic expansion.

How Does the CGPI Work?

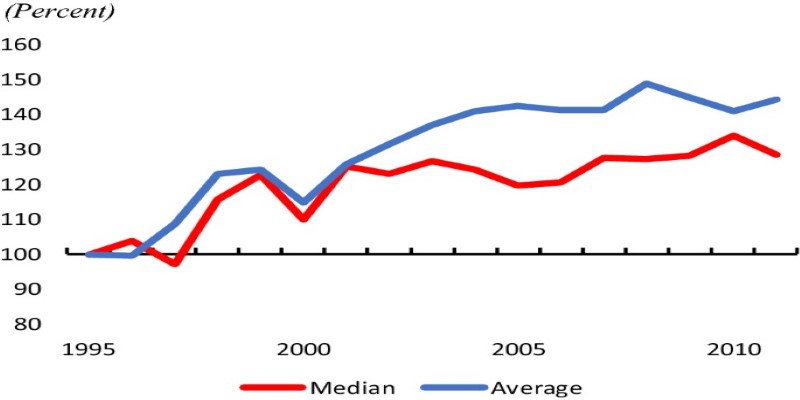

To understand how the CGPI operates, you first need to grasp its composition. The index is compiled by tracking price data for a broad range of capital goods. Government agencies or statistical organizations typically collect this data directly from manufacturers and suppliers. Prices are then aggregated to create an index value that reflects overall price trends.

The CGPI is often expressed as a percentage change over a specific period, such as monthly, quarterly, or annually. For instance, if the CGPI for a given month shows a 2% increase, it means that, on average, the prices of capital goods have risen by 2% compared to the previous period.

Several factors influence the CGPI, including:

Raw Material Costs: Fluctuations in steel, aluminum, or other essential materials directly affect the prices of machinery and equipment.

Global Trade Dynamics: Import-export policies, tariffs, and shipping costs can impact the final cost of capital goods.

Technological Advances: New, more efficient technologies can either drive up costs due to higher demand or reduce prices as production methods improve.

Economic Cycles: In times of economic boom, demand for capital goods often rises, pushing up prices, whereas recessions typically see reduced demand and lower prices.

Why is the CGPI Important?

The Capital Goods Price Index isn’t just another number for economists to pore over—it has real-world implications. Businesses, governments, and investors use the CGPI to make informed decisions about spending, policy-making, and strategy.

Guiding Business Investments: For companies, the CGPI provides a snapshot of how expensive it might be to upgrade or expand their operations. If prices are rising rapidly, businesses may delay purchasing new machinery, potentially slowing down growth. Conversely, a stable or declining CGPI can encourage investment, signaling that it's a good time to acquire the necessary equipment.

Assessing Economic Health: The CGPI acts as a bellwether for industrial activity. Rising prices often indicate strong demand and robust economic performance, while declining prices might hint at economic slowdowns or reduced industrial output.

Supporting Policy Decisions: Governments rely on the CGPI to shape monetary and fiscal policies. For instance, central banks may adjust interest rates based on whether the index suggests inflationary or deflationary trends in the capital goods sector.

Informing Investors: For investors, the CGPI is a crucial economic indicator that helps predict stock market trends, particularly for industries heavily reliant on capital goods, such as manufacturing, construction, and transportation.

Challenges in Interpreting the CGPI

Despite its usefulness, the CGPI isn’t without its challenges. One major issue is the complexity involved in collecting accurate price data. Since capital goods are often custom-made or purchased in bulk, prices can vary widely depending on specifications and order sizes. This variability makes it difficult to create a truly representative index.

Another challenge lies in accounting for technological changes. As equipment evolves, newer models might replace older ones, making it tricky to compare prices over time. Statistical agencies often use techniques like hedonic adjustments to account for these changes, but such methods are not foolproof.

Additionally, the CGPI doesn’t always capture short-term market disruptions, such as supply chain bottlenecks or sudden spikes in raw material prices. While the index is a powerful tool for long-term analysis, it may not always reflect immediate market conditions.

Conclusion

The Capital Goods Price Index (CGPI) may not make headlines as often as consumer price indexes or GDP figures, but its significance cannot be understated. By tracking the cost of essential industrial goods, the CGPI provides invaluable insights into business investment patterns, economic health, and global market dynamics.

Whether you’re an entrepreneur planning your next big purchase, a policymaker shaping economic strategies, or an investor seeking market trends, understanding the CGPI is a step toward making smarter, data-driven decisions. While it’s not without its complexities, the CGPI remains a cornerstone of industrial analysis and a vital tool for navigating the ever-changing economic landscape.